Jaegur

Activist Author

Meet the Tycoons and Titans

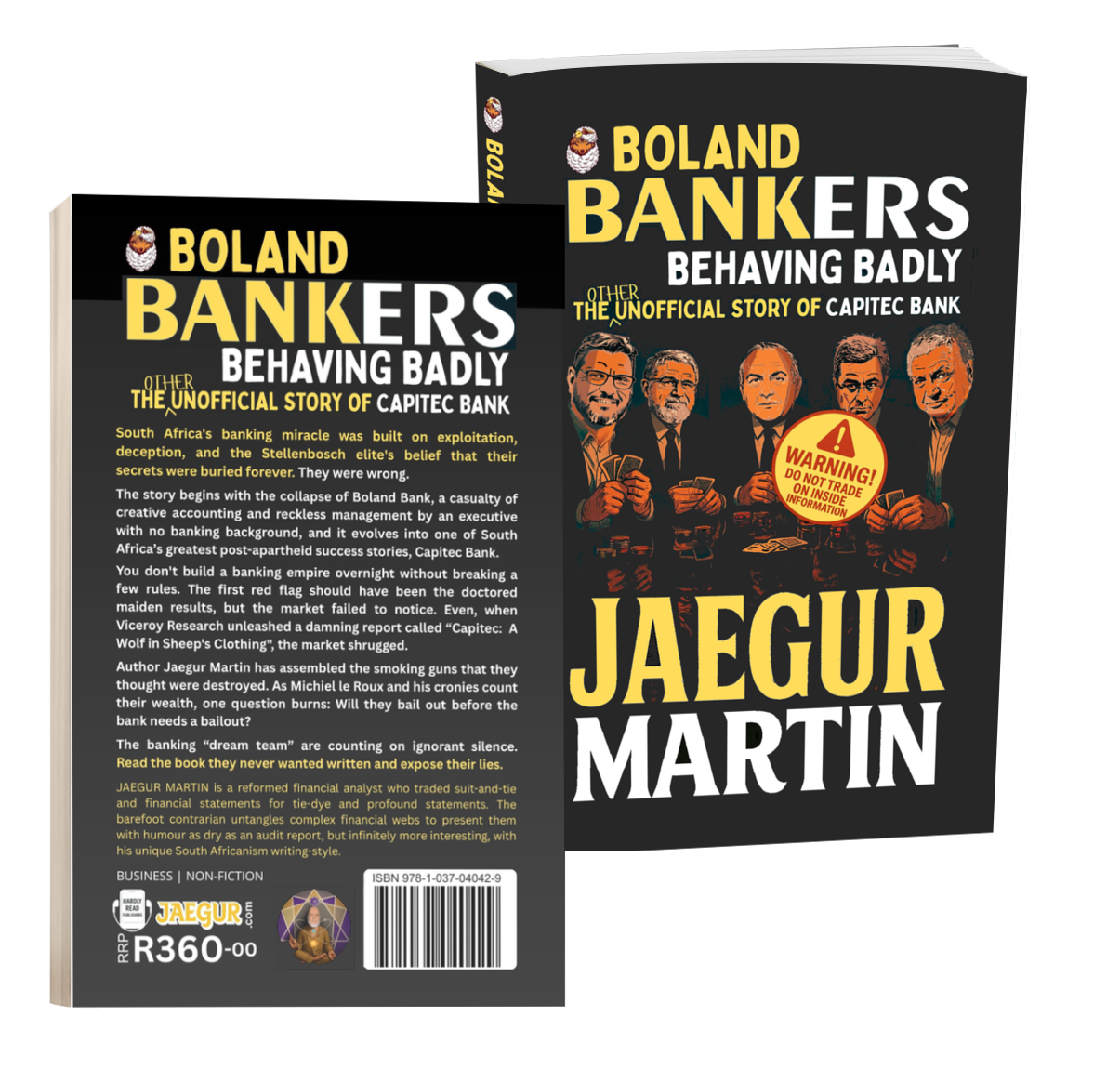

Boland Bankers Behaving Badly introduces you to the following characters:

Christoffel F. Hendrik Wiese

South Africa’s master dealmaker has a knack for making favourable transactions while charming everyone else into feeling like they are getting the better end of a bargain. Whether it’s customers shopping at his stores, or financiers buying into his companies, Wiese always flips the script.

Michiel Scholtz du Pré le Roux

This co-founder of Capitec is a somewhat reserved yet shrewd strategist, known for his understated demeanour and sharp analytical mind. He exudes an air of quiet confidence, preferring thoughtful, calculated decisions over flamboyant displays, with a personality that balances pragmatism and an unyielding focus on innovation.

Johannes “Jannie” Mouton

Founder of PSG Group, known as the “Boere Buffett” for his strategic acumen, Mouton combines bold decision-making with a practical, no-nonsense approach. His straightforward manner and work ethic are rooted in his rural upbringing, with a knack for spotting value others overlook and a reputation for turning setbacks into opportunities.

Markus Johannes Jooste

Jooste was a charismatic, ambitious, yet enigmatic figure, blending persuasive charm with a reputation for high-stakes risk-taking. Behind his polished exterior lay a complex character, marked by sharp intellect, an appetite for power, and a tendency for secrecy and control. He joined PSG Group’s board the week after Capitec listed.

André du Plessis

André du Plessis is meticulous and detail-oriented, embodying the archetype of a disciplined financial mind. He was co-founder and CFO of Capitec for 21 years and is known for his calm and composed demeanour. He combined a sharp focus on numbers with a quiet, steady leadership style that inspires trust and confidence.

Fraser John Perring

Born and bred on a pig farm in Cornwell, with a pre-law degree from Nottingham Trent University, Fraser defies to fit into any traditional mould. He transformed from life as a social worker in 2011 to that of a short-seller, currently heading Viceroy Research.

Support our Book Resellers

There is still nothing better than holding a paperback edition in your hands - get your copy from Takealot or one of the approved retailers listed below.